Looks like you've hit a dead end...

Let's get you back on track!

Copyright 2026

All Rights Reserved

Services

Monthly bookkeeping services

Bookkeeping ensures accuracy, compliance, financial clarity, and smarter business decisions.

Bookkeeping clean up

Bookkeeping cleanup eliminates chaos, boosts accuracy, and strengthens financial confidence.

CFO Services

CFO services improve strategy, cash flow, profitability, and informed financial decisions.

Book Your Free Consultation

No Hourly Billing

No surprise at the end of the month with the amount you need to pay

Make smarter decisions

Each month we take the time to walk through your numbers explain what they mean, build clarity, and answer your questions

Meet the Owner

Noella Auneau

Master in Accounting

Noella Auneau is the founder of Trustful Bookkeeping, where she helps consultants simplify their finances and stay in control as they grow. Noella takes bookkeeping off her clients’ plates by keeping financial records accurate, organized, and always up to date. She understands the realities of consulting businesses and provides personalized support so consultants can focus on serving clients, scaling with confidence, and making smarter financial decisions. Having worked in both the United States and France, Noella brings a global perspective to her work. She holds Bachelor’s and Master’s degrees in Accounting from La Sorbonne University in Paris. When she’s not helping clients get clarity around their numbers, you’ll likely find her in the kitchen, cooking and sharing great food with friends and family.

60-Day money back guarantee

We’re committed to delivering exceptional service and support. If you’re not satisfied within the first 60 days, we’ll refund your investment. For any concerns, please reach out to us.

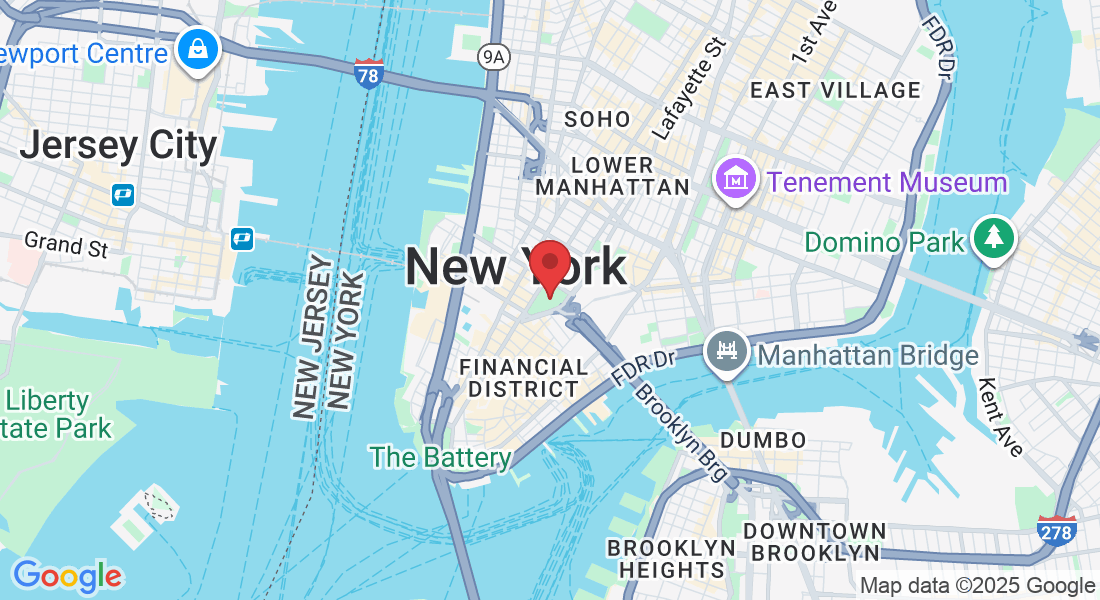

https://storage.googleapis.com/msgsndr/fcVVfLDADrwSbUNkfAbr/media/69316f001d466e4f60993872.png

https://storage.googleapis.com/msgsndr/fcVVfLDADrwSbUNkfAbr/media/69316f001d466ed31499386e.jpg